Discovering Experience

An interactive digest on living and working with humans

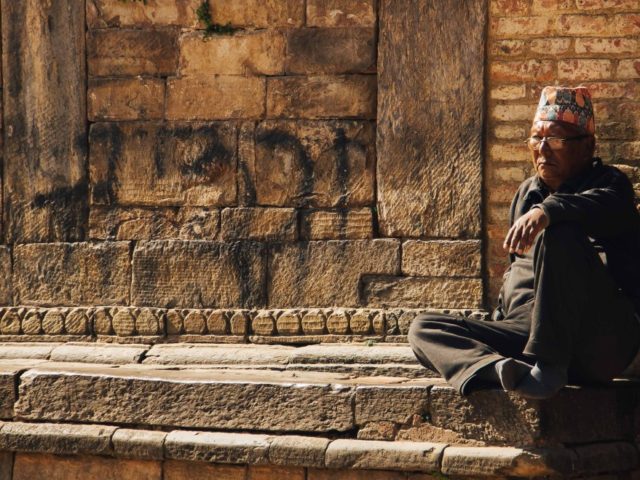

Photo by Trey Ratcliff

Business Strategy, Marketing

The Brand is in Everyone’s Hands, But it’s Marketing’s Responsibility

Think about your company’s market. Which competitors routinely land the most important accounts? In any given market, the companies that have the most meaningful market share are the ones that put in the work to wrangle complexity, develop excellent products, consistently deliver on promises—the list goes on because this type of market position is a result of doing a lot of things really well. This type of success is not incidental—it is earned over time—which is why market-leading companies are big on long-term planning, not just a series of short-term initiatives.

This requires Marketing leadership to demonstrate a commitment to the long game with a marketing strategy built to show performance over time, not just in spurts of demand gen campaigns. To be clear, this framing is not about sacrificing this quarter’s revenue in the interest of next quarter’s revenue. On the contrary, a long-term view pushes us to try harder, to think more critically about the decisions we make today so they hold water tomorrow. Think of it as putting up the bumpers in a bowling lane: this consistent protection gives us the freedom to take on more risks and test new techniques, because no matter what, our ball will not end up in the gutter—we have ensured an acceptable level of performance for the Marketing function.

The safety net and guarantor of future rewards is the Brand

It is incumbent on marketing leaders to seek an appropriate balance between brand and demand and create an ecosystem where these two key imperatives operate together. Yet, many organizations don’t have quantitative methods to tie brand to demand, or they allocate outsized funding to demand to show shareholders the quickest results.

Brand is not just what you see, but what you experience. Marketing leaders need to explain how everything the company does impacts the brand’s health, and why the brand’s health is critical to the business’s future potential. This is the hardest part. In a business environment that incentivizes short-term thinking by setting aggressive quarterly targets, it’s tough to tell the story that we need to invest today to net benefits tomorrow. But someone has to do it—and who ever said Marketing was easy anyway?

Big Pieces of the Big Picture: Three Initiatives That Grow Your Brand Over Time

Below, I recommend three important initiatives every B2B company should be on top of to establish a strong brand presence that endures over time. These initiatives are now ‘table stakes’ for competing in an increasingly crowded marketplace where the buyer has more options than ever before.

1. Formalize Customer Success to Raise Customer Lifetime Value (LTV)

Consistently impress and delight customers, extending the average lifespan of customer relationships and increasing the likelihood of cross-sells, up-sells, and referrals.

- Establish a reliable feedback loop between Sales and Marketing by assigning someone to seek the feedback, document it, and act on it. Customer Success and Customer Marketing teams may have been a ‘nice-to-have’ function, but today they’re competitive differentiators. These people advocate for the ‘voice of the customer across the organization in a way that no other team can, giving the business the information it needs to increase stickiness, reduce attrition, and acquire new customers. To make sure your efforts pay off, index higher towards ensuring customer “success” over customer “retention.” There’s a reason the customer success platform Gainsight has recently been valued at over $1 billion, it helps businesses make more money. In one case study on Gainsight’s website, it documented how Ping Identity was able to increase its renewal risk lead time from less than 60 days to 115 days—what could you do if you had 100% more time to save an account from churning?

- Look at this from an organization-wide perspective, to understand strengths and weaknesses, and work to improve the company’s overall health. Ultimately, we’re raising the value conveyed to the customer and helping them realize it. If your product is weak or customer support is awful, you’re already at a major disadvantage because you won’t be able to deliver long-term value.

2. Craft Context-Aware Communications and Experiences to Become an Approachable Company

Give your audiences the content and experiences they expect and look forward to.

- This requires high awareness around product-market fit and customer challenges. You need a deep understanding of the customer’s pain points, measures of success, and perception of value for your offering. The challenge is more complex with every new vertical or market that is added to the target audience portfolio. Thus, growing firms need to be ready to bring on segment-specific marketing teams and resource them appropriately so market positioning is as relevant as possible to their target decision maker. Amazon Web Services and Splunk are world class examples. Most of their marketing events and website messaging is technical in nature, catering to the technologists that make the buying decision and are ultimately responsible for implementation. Both of these companies take this a step further with solution engineers and sales people dedicated to specific industry verticals.

- Remember, humans are cognitive misers, and we’re always trying to get to the bottom line—if it’s difficult to understand what a company does, skepticism kicks in and introduces friction into a prospect’s decision-making process; conversely, if it’s easy to understand, the prospect just needs to decide whether or not to get in touch: no friction, more clarity, quicker decision.

3. Build Community and Educate the Market

These “surround” initiatives boost brand perception while generating net new demand, growing brand awareness, and accelerating deal velocity.

- Bring people from across industries and markets together, so that vendors, employees, customers, and media can build ideas and relationships, while rallying around a central force, your company’s brand. This develops and increases the bonds of trust and credibility in the marketplace and contributes to more qualified leads that are further down funnel and more likely to buy. Before the pandemic, Salesforce’s annual Dreamforce event would be so heavily attended that San Francisco hotel capacity would max out—this isn’t because people are flying across the nation just to watch product demos, they are there to network with a community of shared interests.

- Nurture a community that educates itself. By default, a company’s education-focused initiatives are self-serving. No one looks forward to sitting through product pitches. So instead of focusing on the product, we need to focus on the customer persona and provide them with value that helps them improve their work performance. This is where community comes in. When it comes to becoming more successful on the job, we benefit more from interactions with peers who deal with similar challenges than information shared by product vendors. This is why winning brands create environments where these connections can take place, keeping the company’s products and services somewhere in the conversation, and ultimately benefiting from the overall success of the people in our community.

<this article was originally published on Little Black Book>

Marketing

The Role of Emotion in Professional Decision Making

Why is B2B decision making emotionally charged? What role do information asymmetries and cognitive biases play in the way we assess value and risk, and build relationships of trust with our own buying committees? In this webinar, I share my perspective on these topics—and also learn a lot from the three other insightful speakers.

Economics, Marketing

Consumer Burnout Has Been Here All Along: A Lesson on Business Foresight and Responsibility

The global systems of commerce are in a constant state of metamorphosis. They undergo gradual changes that can be so drawn out over time, it is tough to notice changes have occurred. Similar to living with someone for many years, sometimes in takes an old photograph to realize how much they’ve changed. Today, though, we’re observing a more hurried trajectory of change that is resulting in a speedy re-ordering of the rules of commerce.

In this case, we’re not talking about the most obvious signs of economic changes, such as the current contraction of consumer demand that is always first experienced by retailers like Target Corporation. Target’s CEO announced this month they were saddled with excess inventory which was ordered when demand was hot, forcing the company to discount a substantial sum of high-ticket price inventory to adjust to today’s more cautious consumer spending patterns.¹ This essay shines a light on a less apparent sign of the significant re-ordering upon us. It is a form of more pronounced socioeconomic stratification, where the boundaries between classes are less permeable to upward mobility and more porous to downward movement. Ultimately, this issue will resolve in more significant, systematic change than temporary price inflation—it revalues the haves and have-nots, and restructures the domestic and global roles available to Americans as economic actors.

This issue will resolve in more significant, systematic change than temporary price inflation—it revalues the haves and have-nots.

Businesses tend to ignore these types of macro-level socioeconomic insights because they require a long-term strategic response that is hard to defend in analyst calls—where the stock market defines winners and losers. But in today’s globalized, highly politicized and uncertain business environment, corporate leadership needs to stand for something bigger than short-term gains in the market casino, where the house always wins.

The confirmation bias that fueled corporate optimism.

From a global perspective, resources in the developed West seem plentiful enough to provide a decent standard of living for all. We have it good. The developed West is made up of a relatively comfortable populace with pockets of poverty and despair; whereas underdeveloped nations present the exact opposite, pockets of wealth amid a largely impoverished populace. This seems right in the context of comparing nations to one another, but the people themselves could care less about being better off than the people in another nation—their standards for equity are local. These localities, defined by financial wherewithal, determine where we make friends, where we raise families, where we work, and where we spend our money. Through this framing, it’s easier to see how closely related one’s social environment is to one’s role in the economy.

The pandemic took a large toll on Americans in the lowest income tier, with almost half experiencing job or wage loss after the coronavirus outbreak began. 45% of middle-income adults and 33% of upper-income adults also faced the same circumstances—albeit, with relatively less bleak consequences.² Job loss for someone who is one paycheck away from losing childcare results in a brutal set of circumstances that can set entire households back months or years just to barely achieve financial stability, forget upward economic mobility, it’s often far out of reach.

We entered 2022 with a general sense of optimism. Government-driven financial support helped many households avert dire circumstances with rent relief, eviction moratoriums, loan forbearance programs, and boosted unemployment insurance checks. Many middle and upper-income households actually made it through the pandemic recovery quite well, getting mortgage and student loan relief, saving money working from home, and benefitting from one of the best years in stock market history. But we can’t forget that in December 2020, 14% of American adults (nearly 30 million) reported having too little to eat in the past seven days, a rate that dropped only to 9% (nearly 20 million) in October 2021.³ Indeed, the poorest households benefited from government stimulus payouts, but their situation is so fragile, they also exhausted these funds faster.⁴

We can’t forget that in December 2020, 14% of American adults reported having too little to eat.

From a business perspective, many firms planned their way through the economic recovery by acting on only half of the story—the veneer of national prosperity reflected in middle and upper-income financials. An irresponsible confirmation bias that ignored the 64% of Americans who are living paycheck to paycheck.⁵

An economy high on synthetic stimulants simulated prosperity.

The economic recovery found the nation with an abundance of job opportunities—fueled by a synthetically stimulated economy where people were buying stuff at such a voracious rate, companies had to staff up with speed to handle increased demand. And even then, it wasn’t enough—we used all the damn semiconductor chips. Widespread supply chain shortages impacted every nation. Consumer demand was so hot we put a record sum of freight on ocean carriers causing bottlenecks just to get products to port.⁶

In 2020, the United States personal savings rate hit an all-time record high of 33.8%. To provide an idea of just how monumental this is, the previous high was 17.3%, set in 1975. Today, that rate is much lower, and it’s a leading indicator we cannot ignore. In April 2022 the personal savings rate was a meager 4.4%, the lowest it’s been since 2008, in the heart of the Great Recession.⁷

A flaming addiction to consumerism, record demand, unexpected new flows of disposable income, over 40% more money in circulation⁸, record household savings rates, low unemployment. We not only have more money to spend, but we also have more options for spending that money than ever before.

It has all led us to a state of comfortable complacency.

Businesses need to adapt immediately to fight for long-term stability

When you hear the wealthy switch their tone from speculatively-excited to cautiously-concerned, you know something’s afoot. You see, we’ve overheated the economy, and we’re also burning ourselves out. The federal government is having a bear of a time figuring out how we’re going to come out of this situation with the least damages inflicted—it has to look after almost 330 million people.

Businesses also need to adapt, but most of them will not take proactive measures, instead opting to delay reaction until they start to feel the consequences. This means retailers and other consumer-facing (B2C) businesses that deal with the most basic consumer needs, like housing and transportation, are already starting to face these new circumstances. Which means that soon, the thousands of business-to-business (B2B) companies that count on revenue from those businesses, such as software and financial technology firms, will start to feel the brunt of the problem.

Rather than starting with the immediate business problem, we began this essay by covering the socioeconomic situation of the American people to shine a light on the human condition. If we want to improve the way our businesses respond to market shifts, we need to understand what’s going on with the very people that make all of our companies viable—the consumers. When you work in the B2B sector, these people are often out of the picture because they’re seen as someone else’s problem, namely, your customer’s problem. However, when economic patterns change with great heft and speed, we have to conduct a truly rigorous root cause analysis that brings us all the way to the end consumer.

This consumer-level study prepares us to better absorb market-wide shocks without resorting to drastic measures like massive layoffs and office closures. It’s not that successful companies don’t conduct market research and planning—but most B2B companies don’t have have repeatable systems in place to research, understand, and act on consumer insights.

Most B2B companies don’t have have systems in place to research, understand, and act on consumer insights.

B2B companies need to bolster and adjust go-to-market teams

In this case, our upcoming business challenges are rooted all the way down to the consumer level. The confluence of destabilizing forces will impact the financial condition of the average American, prompting a slide in consumer demand over the next year. This will eventually impact B2B product and service providers. So how should we react?

First, we must adapt our expectations and reset revenue targets to give go-to-market teams a fighting chance at closing the year on a high-note. Adapted targets send the responsible message to the market, they show analysts and shareholders that there’s an adept team keen to reduce uncertainty and maintain stability.

Second, Sales teams need meaningful corporate support. Many B2B salespeople have been nurturing substantive pipelines, keen to make up for revenue lost throughout the pandemic. These sales people need executive backup in the form of realistic goals and cross-team collaboration to bring deals across the finish line.

Finally, Marketing should not be pushed into over-indexing on lead generation—a common knee-jerk reaction to uncertainty. Instead, when market demand is expected to decrease and competition is expected to heighten, Marketing needs to double-down on balanced investments that span the full funnel:

- Strong brand equity and perception resetting programs to drive awareness and brand preference, in preparation for a tougher competitive environment. You can also think of this as critical air-cover for Sales teams.

- Mid-funnel nurture programs centered on offering prospects a rich value exchange that incentivizes them to give us their time and attention, while accelerating high-propensity leads.

- Advance overall customer success with an obsessive focus on ensuring our customers are getting the most value for their dollar and enjoying a memorable, delightful experience with the brand. Deliberate Marketing touchpoints throughout the customer experience journey deepen trust, increase retention, and improve lifetime value.

There’s no need to panic, cool heads always prevail. These economic cycles happen almost like clockwork (take a look at time series charts and you’ll see a recession was somewhat overdue). No company will be able to change the course of an economic downturn or spur an economic boom, but B2B company leaders can boost the effectiveness of long-term planning by studying the end consumer—rather, the people behind the consumption. What’s going on in their milieu, how are their socioeconomic conditions and perceptions of value changing? As B2B companies, how will these changes impact our customers who deal directly with consumers? The consumer will always have the final say.

NOTES

- Sarah Nassauer, “Target CEO Says Unloading Excess Inventory Is a Necessary Pain,” WSJ, accessed June 12, 2022, https://www.wsj.com/articles/target-ceo-says-unloading-excess-inventory-is-a-necessary-pain-11654703424.

- “COVID-19 Pandemic Pinches Finances of America’s Lower- and Middle-Income Families,” Pew Research Center’s Social & Demographic Trends Project (blog), April 20, 2022, https://www.pewresearch.org/social-trends/2022/04/20/covid-19-pandemic-pinches-finances-of-americas-lower-and-middle-income-families/.

- “Tracking the COVID-19 Economy’s Effects on Food, Housing, and Employment Hardships,” Center on Budget and Policy Priorities, accessed June 14, 2022, https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-economys-effects-on-food-housing-and.

- “Pandemic-Era ‘Excess Savings’ Are Dwindling for Many – The New York Times,” accessed June 15, 2022, https://www.nytimes.com/2021/12/07/business/pandemic-savings.html.

- Jessica Dickler, “As Inflation Heats up, 64% of Americans Are Now Living Paycheck to Paycheck,” CNBC, March 8, 2022, https://www.cnbc.com/2022/03/08/as-prices-rise-64-percent-of-americans-live-paycheck-to-paycheck.html.

- “Topic: Container Shipping,” Statista, accessed June 12, 2022, https://www.statista.com/topics/1367/container-shipping/.

- U.S. Bureau of Economic Analysis, “Personal Saving Rate,” FRED, Federal Reserve Bank of St. Louis (FRED, Federal Reserve Bank of St. Louis, January 1, 1959), https://fred.stlouisfed.org/series/PSAVERT.

- Washington Post. “Inflation Has Fed Critics Pointing to Spike in Money Supply.” Accessed June 21, 2022. https://www.washingtonpost.com/business/2022/02/06/federal-reserve-inflation-money-supply/.

Culture & Communication, Marketing

Empathetic business sounds great (but most firms don’t have the guts to stick it out)

When Dove launched its “Real Women” campaign it stood out as a brand that validates each woman for the unique being she is. When combing through a dizzying array of beauty and hygiene products

Business Strategy, Culture & Communication

Ethics: Individually Subjective, Universally Objective.

We’re at a point in the evolutionary path of commerce where it’s becoming difficult for consumers to separate business and philosophy. Buyers have so many good options for any given product that they no longer have to settle. This is creating a formidable consumer force that, fortified by unprecedented access to a near-endless supply of information, understands the significant role corporations have in influencing societal outcomes. Continue reading …

Advertising & Marketing, Culture & Communication

Marketing Addiction: Normalization in the indefatigable tobacco industry

Does society think it’s reasonable to profit from someone else’s loss? It certainly seems that way if we look at the tobacco industry. Revenue for U.S. tobacco companies increased 50% from $78 billion in 2001 to $117 billion in 2016. At the same time, the World Health Organization reports that tobacco use is responsible for the death of over seven million people per year. Continue reading …