Marketing

The Role of Emotion in Professional Decision Making

Why is B2B decision making emotionally charged? What role do information asymmetries and cognitive biases play in the way we assess value and risk, and build relationships of trust with our own buying committees? In this webinar, I share my perspective on these topics—and also learn a lot from the three other insightful speakers.

Economics, Marketing

Consumer Burnout Has Been Here All Along: A Lesson on Business Foresight and Responsibility

The global systems of commerce are in a constant state of metamorphosis. They undergo gradual changes that can be so drawn out over time, it is tough to notice changes have occurred. Similar to living with someone for many years, sometimes in takes an old photograph to realize how much they’ve changed. Today, though, we’re observing a more hurried trajectory of change that is resulting in a speedy re-ordering of the rules of commerce.

In this case, we’re not talking about the most obvious signs of economic changes, such as the current contraction of consumer demand that is always first experienced by retailers like Target Corporation. Target’s CEO announced this month they were saddled with excess inventory which was ordered when demand was hot, forcing the company to discount a substantial sum of high-ticket price inventory to adjust to today’s more cautious consumer spending patterns.¹ This essay shines a light on a less apparent sign of the significant re-ordering upon us. It is a form of more pronounced socioeconomic stratification, where the boundaries between classes are less permeable to upward mobility and more porous to downward movement. Ultimately, this issue will resolve in more significant, systematic change than temporary price inflation—it revalues the haves and have-nots, and restructures the domestic and global roles available to Americans as economic actors.

This issue will resolve in more significant, systematic change than temporary price inflation—it revalues the haves and have-nots.

Businesses tend to ignore these types of macro-level socioeconomic insights because they require a long-term strategic response that is hard to defend in analyst calls—where the stock market defines winners and losers. But in today’s globalized, highly politicized and uncertain business environment, corporate leadership needs to stand for something bigger than short-term gains in the market casino, where the house always wins.

The confirmation bias that fueled corporate optimism.

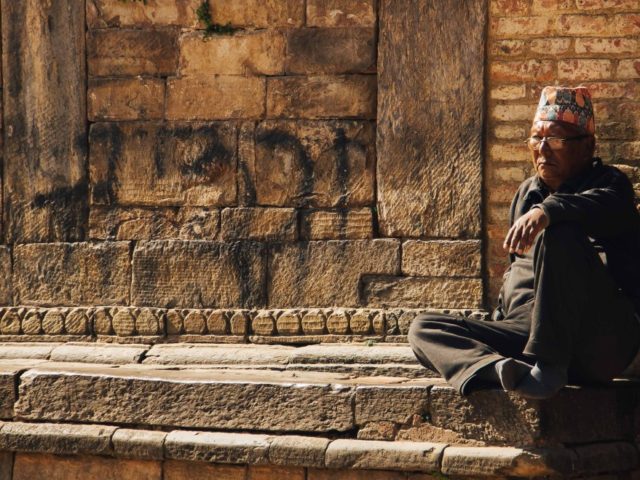

From a global perspective, resources in the developed West seem plentiful enough to provide a decent standard of living for all. We have it good. The developed West is made up of a relatively comfortable populace with pockets of poverty and despair; whereas underdeveloped nations present the exact opposite, pockets of wealth amid a largely impoverished populace. This seems right in the context of comparing nations to one another, but the people themselves could care less about being better off than the people in another nation—their standards for equity are local. These localities, defined by financial wherewithal, determine where we make friends, where we raise families, where we work, and where we spend our money. Through this framing, it’s easier to see how closely related one’s social environment is to one’s role in the economy.

The pandemic took a large toll on Americans in the lowest income tier, with almost half experiencing job or wage loss after the coronavirus outbreak began. 45% of middle-income adults and 33% of upper-income adults also faced the same circumstances—albeit, with relatively less bleak consequences.² Job loss for someone who is one paycheck away from losing childcare results in a brutal set of circumstances that can set entire households back months or years just to barely achieve financial stability, forget upward economic mobility, it’s often far out of reach.

We entered 2022 with a general sense of optimism. Government-driven financial support helped many households avert dire circumstances with rent relief, eviction moratoriums, loan forbearance programs, and boosted unemployment insurance checks. Many middle and upper-income households actually made it through the pandemic recovery quite well, getting mortgage and student loan relief, saving money working from home, and benefitting from one of the best years in stock market history. But we can’t forget that in December 2020, 14% of American adults (nearly 30 million) reported having too little to eat in the past seven days, a rate that dropped only to 9% (nearly 20 million) in October 2021.³ Indeed, the poorest households benefited from government stimulus payouts, but their situation is so fragile, they also exhausted these funds faster.⁴

We can’t forget that in December 2020, 14% of American adults reported having too little to eat.

From a business perspective, many firms planned their way through the economic recovery by acting on only half of the story—the veneer of national prosperity reflected in middle and upper-income financials. An irresponsible confirmation bias that ignored the 64% of Americans who are living paycheck to paycheck.⁵

An economy high on synthetic stimulants simulated prosperity.

The economic recovery found the nation with an abundance of job opportunities—fueled by a synthetically stimulated economy where people were buying stuff at such a voracious rate, companies had to staff up with speed to handle increased demand. And even then, it wasn’t enough—we used all the damn semiconductor chips. Widespread supply chain shortages impacted every nation. Consumer demand was so hot we put a record sum of freight on ocean carriers causing bottlenecks just to get products to port.⁶

In 2020, the United States personal savings rate hit an all-time record high of 33.8%. To provide an idea of just how monumental this is, the previous high was 17.3%, set in 1975. Today, that rate is much lower, and it’s a leading indicator we cannot ignore. In April 2022 the personal savings rate was a meager 4.4%, the lowest it’s been since 2008, in the heart of the Great Recession.⁷

A flaming addiction to consumerism, record demand, unexpected new flows of disposable income, over 40% more money in circulation⁸, record household savings rates, low unemployment. We not only have more money to spend, but we also have more options for spending that money than ever before.

It has all led us to a state of comfortable complacency.

Businesses need to adapt immediately to fight for long-term stability

When you hear the wealthy switch their tone from speculatively-excited to cautiously-concerned, you know something’s afoot. You see, we’ve overheated the economy, and we’re also burning ourselves out. The federal government is having a bear of a time figuring out how we’re going to come out of this situation with the least damages inflicted—it has to look after almost 330 million people.

Businesses also need to adapt, but most of them will not take proactive measures, instead opting to delay reaction until they start to feel the consequences. This means retailers and other consumer-facing (B2C) businesses that deal with the most basic consumer needs, like housing and transportation, are already starting to face these new circumstances. Which means that soon, the thousands of business-to-business (B2B) companies that count on revenue from those businesses, such as software and financial technology firms, will start to feel the brunt of the problem.

Rather than starting with the immediate business problem, we began this essay by covering the socioeconomic situation of the American people to shine a light on the human condition. If we want to improve the way our businesses respond to market shifts, we need to understand what’s going on with the very people that make all of our companies viable—the consumers. When you work in the B2B sector, these people are often out of the picture because they’re seen as someone else’s problem, namely, your customer’s problem. However, when economic patterns change with great heft and speed, we have to conduct a truly rigorous root cause analysis that brings us all the way to the end consumer.

This consumer-level study prepares us to better absorb market-wide shocks without resorting to drastic measures like massive layoffs and office closures. It’s not that successful companies don’t conduct market research and planning—but most B2B companies don’t have have repeatable systems in place to research, understand, and act on consumer insights.

Most B2B companies don’t have have systems in place to research, understand, and act on consumer insights.

B2B companies need to bolster and adjust go-to-market teams

In this case, our upcoming business challenges are rooted all the way down to the consumer level. The confluence of destabilizing forces will impact the financial condition of the average American, prompting a slide in consumer demand over the next year. This will eventually impact B2B product and service providers. So how should we react?

First, we must adapt our expectations and reset revenue targets to give go-to-market teams a fighting chance at closing the year on a high-note. Adapted targets send the responsible message to the market, they show analysts and shareholders that there’s an adept team keen to reduce uncertainty and maintain stability.

Second, Sales teams need meaningful corporate support. Many B2B salespeople have been nurturing substantive pipelines, keen to make up for revenue lost throughout the pandemic. These sales people need executive backup in the form of realistic goals and cross-team collaboration to bring deals across the finish line.

Finally, Marketing should not be pushed into over-indexing on lead generation—a common knee-jerk reaction to uncertainty. Instead, when market demand is expected to decrease and competition is expected to heighten, Marketing needs to double-down on balanced investments that span the full funnel:

- Strong brand equity and perception resetting programs to drive awareness and brand preference, in preparation for a tougher competitive environment. You can also think of this as critical air-cover for Sales teams.

- Mid-funnel nurture programs centered on offering prospects a rich value exchange that incentivizes them to give us their time and attention, while accelerating high-propensity leads.

- Advance overall customer success with an obsessive focus on ensuring our customers are getting the most value for their dollar and enjoying a memorable, delightful experience with the brand. Deliberate Marketing touchpoints throughout the customer experience journey deepen trust, increase retention, and improve lifetime value.

There’s no need to panic, cool heads always prevail. These economic cycles happen almost like clockwork (take a look at time series charts and you’ll see a recession was somewhat overdue). No company will be able to change the course of an economic downturn or spur an economic boom, but B2B company leaders can boost the effectiveness of long-term planning by studying the end consumer—rather, the people behind the consumption. What’s going on in their milieu, how are their socioeconomic conditions and perceptions of value changing? As B2B companies, how will these changes impact our customers who deal directly with consumers? The consumer will always have the final say.

NOTES

- Sarah Nassauer, “Target CEO Says Unloading Excess Inventory Is a Necessary Pain,” WSJ, accessed June 12, 2022, https://www.wsj.com/articles/target-ceo-says-unloading-excess-inventory-is-a-necessary-pain-11654703424.

- “COVID-19 Pandemic Pinches Finances of America’s Lower- and Middle-Income Families,” Pew Research Center’s Social & Demographic Trends Project (blog), April 20, 2022, https://www.pewresearch.org/social-trends/2022/04/20/covid-19-pandemic-pinches-finances-of-americas-lower-and-middle-income-families/.

- “Tracking the COVID-19 Economy’s Effects on Food, Housing, and Employment Hardships,” Center on Budget and Policy Priorities, accessed June 14, 2022, https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-economys-effects-on-food-housing-and.

- “Pandemic-Era ‘Excess Savings’ Are Dwindling for Many – The New York Times,” accessed June 15, 2022, https://www.nytimes.com/2021/12/07/business/pandemic-savings.html.

- Jessica Dickler, “As Inflation Heats up, 64% of Americans Are Now Living Paycheck to Paycheck,” CNBC, March 8, 2022, https://www.cnbc.com/2022/03/08/as-prices-rise-64-percent-of-americans-live-paycheck-to-paycheck.html.

- “Topic: Container Shipping,” Statista, accessed June 12, 2022, https://www.statista.com/topics/1367/container-shipping/.

- U.S. Bureau of Economic Analysis, “Personal Saving Rate,” FRED, Federal Reserve Bank of St. Louis (FRED, Federal Reserve Bank of St. Louis, January 1, 1959), https://fred.stlouisfed.org/series/PSAVERT.

- Washington Post. “Inflation Has Fed Critics Pointing to Spike in Money Supply.” Accessed June 21, 2022. https://www.washingtonpost.com/business/2022/02/06/federal-reserve-inflation-money-supply/.

Markets & Investing

Reopening Rally, Impending Crash, and East Asia Diversification

My market statement for today is: hold. Many people will panic-sell to take minor profits or cut their losses. It’s fine to sell if you lost confidence, but don’t panic-sell an investment you conducted due diligence on. The markets will rally soon. Measured “reopening” of pandemic-related restrictions is beginning (for example, 1/3 of British adults are vaccinated). This will boost global commerce in the short term. As the world’s largest economies stamp out the high prevalence of COVID-19, we will see an even greater rally.

We will see a huge stock market drop in 2021 or 2022, in the meanwhile we should see dips like the present one. I suggest working on diversification of your portfolio and East Asia is looking very good. Check out Korean ETFs, like EWY (24% of its holdings are in Samsung), for instance, and any other funds that give you Asian exposure. Watch the 1/22/2021 Jeremy Grantham video interview on Bloomberg where he talks about the impending crash, irrationality of the markets and its actors, and investment diversification ideas.

Beware of Chinese company ETFs. I researched this investment option because I wanted to get in on the booming market—consumer spending is going up and tech co’s are growing rapidly—but investment options are sketchy. You cannot actually invest directly in Chinese companies, as the government prohibits this activity. Yet there are ETFs like MCHI listing holdings of Chinese heavyweights like Alibaba, Tencent, and JD. Here’s the rub, these aren’t holdings in actual Chinese businesses, they are holdings in shell companies called Variable Interest Entities (VIEs). Enron also used this structure. Read more on the Globescan Capital website.

Culture & Communication, Marketing

Empathetic business sounds great (but most firms don’t have the guts to stick it out)

When Dove launched its “Real Women” campaign it stood out as a brand that validates each woman for the unique being she is. When combing through a dizzying array of beauty and hygiene products

Business Strategy, Culture & Communication

Ethics: Individually Subjective, Universally Objective.

We’re at a point in the evolutionary path of commerce where it’s becoming difficult for consumers to separate business and philosophy. Buyers have so many good options for any given product that they no longer have to settle. This is creating a formidable consumer force that, fortified by unprecedented access to a near-endless supply of information, understands the significant role corporations have in influencing societal outcomes. Continue reading …

Advertising & Marketing, Culture & Communication

Marketing Addiction: Normalization in the indefatigable tobacco industry

Does society think it’s reasonable to profit from someone else’s loss? It certainly seems that way if we look at the tobacco industry. Revenue for U.S. tobacco companies increased 50% from $78 billion in 2001 to $117 billion in 2016. At the same time, the World Health Organization reports that tobacco use is responsible for the death of over seven million people per year. Continue reading …

Advertising & Marketing, Business Strategy

It’s a buyer’s market, but they don’t know it yet.

People have way too much going on in their lives to anguish over simple purchase decisions like buying toilet paper or a bag of onions, so when we go shopping for these mundane products we tend to buy what we’re used to or whatever is on sale. This makes sense because they are low-stakes purchases. But, counterintuitively, we behave in the same simple way when making most of our purchase decisions, whether or not they should be more complex. Human psychology and clever brand marketing play a role in the way we make purchase decisions, but the way we perceive value is changing in favor of the consumer and brands have some catching up to do. Continue reading …

Business Strategy

We need more data we don’t know we need, and social scientists can help.

Breakthrough innovations can appear to be the result of some inexplicable phenomenon that is realized when the right people get together to “think big.” But the reality is that these events are less about luck and more about logic. Not to completely dismiss the value of human emotions and grit, but we can actually explain any success story by objectively reviewing the conditions leading up to success, by assessing indisputable facts. From this grounded perspective, we can see how important it is for executives to be thirsty for facts and skeptical about opinions. Continue reading …

Business Strategy, Culture & Communication

Humans: Inherently Innovative, Consistently Iterative

Researchers recently discovered evidence of early human innovation dating back to around 320,000 years, about 100,000 years earlier than previous estimates. As part of the Smithsonian Institution’s Human Origins Program, excavations in the Olorgesailie Basin of Southern Kenya resulted in the discovery of advanced tools made of stone and the use of coloring pigments, indicating the presence of complex technological and sociological behaviors. If we look beyond our own species, Homo sapiens, technological innovation dates all the way back to about 1.2 million years ago, when other hominin species crafted large, less intricate handaxes out of stone. Continue reading …

Business Strategy, Marketing

The Empathetic Brand and Being Human with Technology

Empathetic brands are those which are perceived to be favorable, not just because of price or utility, but because of the good feelings we get when thinking of the brand. A company’s brand image is the culmination of a multitude of factors, but it is the personal, private, one-on-one moments between customer and business that matter the most when it comes to the perception of empathy.

At well-regarded companies, staff are empathetic to customer needs, requests, and concerns. They are proactive at delivering a stellar customer experience, and they are proactively prepared with “rules of engagement” that help them mitigate potentially negative customer interactions. The operative word here is “potentially,” because it represents staff preparedness to be proactive, rather than reactive, to any situation. These employees are empowered to delight the customer, not simply because “the customer is always right,” but because staff aim to listen, understand, act fairly, and mitigate issues tactfully. They treat humans like humans, relying on a honed capability to be human, without fearing disciplinary action from management. Continue reading …